$425 copay for each Medicare-covered hospital stay. 'The maximum out-of-pocket limit is covered under 'Inpatient Hospital Care'.' Except in an emergency your doctor must tell the plan that you are going to be admitted to the hospital. Skilled Nursing Facility (SNF). A copay is a fixed amount of money you pay for a certain service. Your health insurance plan pays the rest of the cost. Coinsurance refers to percentages. Our Medicare Advantage plans use.

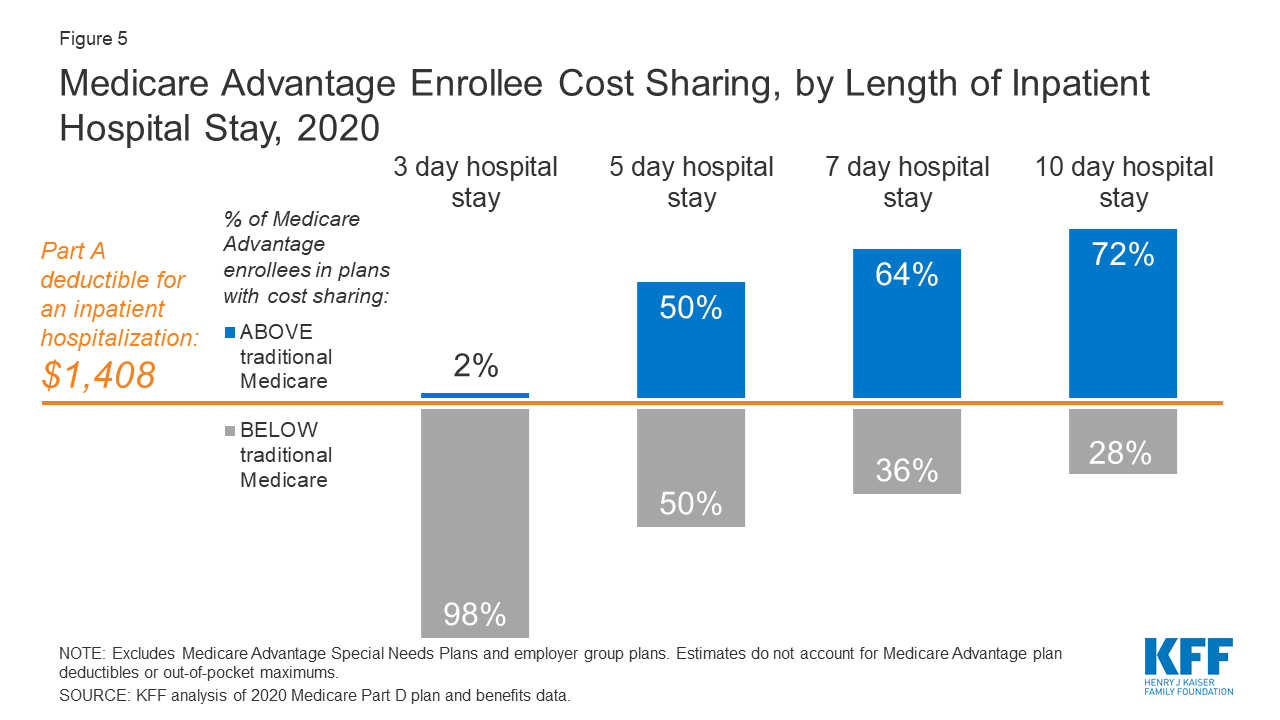

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,408 in 2020, an increase of $44 from $1,364 in 2019. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Medicare beneficiaries may pay a deductible for hospital services. Under Original Medicare, for hospital inpatient services, beneficiaries pay a deductible of $1,408 and no coinsurance for days 1– 60 of each benefit period. Beneficiaries pay a coinsurance amount of. This includes if you're diagnosed with COVID-19 and might otherwise have been discharged from the hospital after an inpatient stay, but instead you need to stay in the hospital under quarantine. You’ll still pay for any hospital deductibles, copays, or coinsurances that apply.

By Kolt Legette

Since 2003, Kolt Legette has helped clients navigate the often-confusing world of insurance. His number one goal is protecting the medical and financial wellbeing of every person he speaks with, wheth .. sceler they choose to buy insurance or not. Kolt loves representing the best brands in medical insurance as it allows him to provide side-by-side comparisons for his clients. This allows the client to decide which company works best for them. By putting the needs of the client above everything else, Kolt helps real people find affordable health insurance solutions for their most pressing healthcare needs. With his belief that peace of mind is priceless, Kolt's goal in every interaction is to make sure every person he speaks to leaves with the peace of mind they rightfully deserveRead more

Generally speaking, no. This can vary a bit, depending on whether or not you have Medicare Advantage. There can also be some fees related to your doctor's visit, like prescription drug costs, that often do have a copay. We’ll go through the full structure of your out-of-pocket fees with Medicare as they relate to doctor visits, so you can know what to expect when you walk in the door.

Copay vs. Coinsurance

Copays and coinsurance fees are often discussed when you hear about your medical insurance plan. Most of the time, a copay or copayment refers to a single fee that you will have to pay when you receive health care. For example, your insurance may charge a $20 copay for each doctor visit, and you’ll have to pay this same fee no matter which services you receive at the doctor’s office.

A coinsurance functions as a percentage-based cost-sharing agreement, rather than a set fee. For example, Medicare Part B has a 20 percent coinsurance, which means that Medicare pays 80 pecent of the approved amount of your medical services, and you pay the remaining 20 percent. Some private insurance plans can have both a copay and a coinsurance for different scenarios.

Both copay and coinsurance fees will only apply after you’ve paid your annual deductible.

Does Medicare Use Copays?

Yes and no. Importantly, Part B of Medicare never uses copays. Part B has a deductible of $203per benefit period, and after this, you will pay 20 percent of your costs, which is your coinsurance. Medicare Part B covers doctor visits, as well as other things like durable medical equipment, so you will never pay a copay for a doctor visit under Original Medicare, only a coinsurance.

Mental Health Services -- The Exception

Mental health services are the one regular exception to this rule. There may be some instances in which you don't have to pay a copay for these services, but most of the time that is the arrangement that Medicare will use. Make sure to check the details with the office you are dealing with and with Medicare.

What About Part A?

Medicare Part A does not technically use a copayment, but the fees are very similar to what most people associate with copays. Part A hospital insurance uses a so-called coinsurance fee, but this fee is not percentage-based and is pre-set with a few tiers depending on the length of your skilled nursing facility or hospital stay. Because it is a pre-set fee, it does function like a copay, despite being called a coinsurance.

Copays with Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare. Although there are some regulations on these costs, there will be more variety.

This means that some Medicare Advantage plans will have copays, and others won’t. The amount of the copay will vary, and some plans may use copays for one type of care while using a coinsurance for others; it depends. If you have a Medicare Advantage plan, make sure that you know in advance what the copay is, so you can be prepared when you go see your healthcare provider.

How do Part D Prescription Drug Plans Fit In?

Although Part D plans usually won't apply to your actual doctor visit, they are still very relevant to the process. If your doctor prescribes you medication during your visit, it will usually be covered by a Part D plan. For this reason, you should make sure to understand the copay structure and out-of-pocket fees associated with your prescription drug plan, whether it’s Part D or another private plan.

Like Medicare Advantage plans, Part D plans are offered by private insurance companies. This means that they are also free to use copays, and the majority will. Prescription drug coverage is especially suited to copay structures since people refill their prescriptions often. If you have a Part D plan, it most likely uses a copay.

When it comes to Part D plans, there will usually be a tier list that has a higher copay for drugs higher on the list. If possible, try to know what the copay is before you go in to get your prescription filled.

Can Medigap Plans Help?

Medigap plans, or Medicare Supplement Plans, are plans that cover some of your Medicare out-of-pocket costs. With these plans, you will only pay a monthly premium, with no other out-of-pocket costs. As an example, these plans can cover your Part B coinsurance, and cover many other out-of-pocket fee categories. You can read more about Medigap plans at medicare.gov.

Medigap plans only cover out-of-pocket costs, so they won’t cover medical services. These plans only cover Original Medicare, not Medicare Advantage or Part D drug plans.

Because they don’t cover Medicare Advantage, Medigap plans won’t ever be able to pay for your copay. This is simply because there is no usual copay under Original Medicare. Some Medigap plans will cover the Part A coinsurance, which as we mentioned earlier, does function the same way as a copay.

Things to Keep in Mind

Overall, understanding copays with Medicare is simple, just don’t ignore it until the last minute! If you have a Medicare Advantage plan, make sure that you understand your out-of-pocket fees so a copay won’t surprise you. Otherwise, you'll rarely have to deal with copays with Medicare.

Related Articles

Last Updated : 03/19/20215 min read

If you are a Medicare beneficiary and you go to the hospital, the hospital cannot refuse to admit or treat you based on lack of payment of your Medicare Part A deductible. In 2021, this amount is $1,484. Additionally, if you seek emergency treatment, you will have access to emergency services regardless of ability to pay, according to the Emergency Medical Treatment & Labor Act. The Center for Medicare and Medicaid Services (CMS) has very strict guidelines on when and how a hospital or other health care provider can collect a Medicare deductible or copayment amount from beneficiaries. Here’s what you need to know.

Find affordable Medicare plans in your area

Can a hospital request prepayment of a Medicare hospital deductible before admitting me?

CMS guidelines explicitly state that a hospital may not request prepayment of any Medicare deductible or copayment as a condition for admission or treatment, except in the very rare cases where the hospital has a policy of requesting prepayment from other patients who are not Medicare beneficiaries.

The guidelines further state that should the hospital make a prepayment request, it must be presented clearly as a request “without undue pressure.” There should never be any suggestion that you or your loved one will not get necessary care and treatment if you cannot or do not pay your Medicare deductible in advance.

CMS strongly encourages any hospitals or other health-care facilities that request prepayment to post a sign clearly stating that no one will be refused admission or medical care if he or she is unable to pay the Medicare deductible or other advance deposit.

Can a hospital deny any treatment while I’m a patient if I haven’t paid my Medicare deductible?

The rules in this situation are also quite clear:

- If you have not exhausted your inpatient hospital benefits under Part A, the hospital generally cannot deny treatment or demand payment of your Medicare hospital deductible or copayment.

- If you have exhausted your covered inpatient days under Part A, the hospital generally may apply the same prepayment policy it has in place for uninsured patients. This policy may vary from hospital to hospital, so be sure to talk to someone in the billing department if you are concerned that your inpatient benefits may run out during your admission.

Keep in mind, however, that the hospital may require prepayment for services such as comfort items (such as televisions, radios, and beauty and barber services) and private duty nursing that are not covered by Medicare. If you do not make the required payment or deposit, the hospital may deny you those non-covered items and services while you are an inpatient in the hospital.

If you have not enrolled in Medicare Part B (medical insurance) or a Medicare Advantage plan, and you don’t have other health insurance, the hospital may ask you to pay a deposit or show proof of ability to pay for the services of any staff doctor who might treat you during your stay.

Can a hospital force me to leave if I can’t pay my Medicare deductible?

If the hospital wants to discharge you and you don’t agree for any reason, you have the right to request a fast appeal from the Beneficiary and Family Centered Care Quality Improvement Organization (BFCC-QIO). Within two days of your admission, the hospital must provide you with a notice called “An Important Message,” or IM, about your rights under Medicare. This notice has contact information for the BFCC-QIO and instructions on how to request a fast appeal.

The hospital cannot force you to leave during the appeal process if you’ve followed the instructions and are within the appeal time frame.

How can I get help paying my Medicare hospital deductible?

If you are enrolled in Original Medicare (Part A and Part B) and are concerned about your out-of-pocket Medicare expenses, you may be eligible for a Medicare Supplement insurance plan, or Medigap. Is terraria for mac on steam. These plans may cover all or part of your Part A and Part B copayment/coinsurance amounts and extend your inpatient benefits. Some Medicare Supplement insurance plans may cover your Part A and/or Part B deductible.

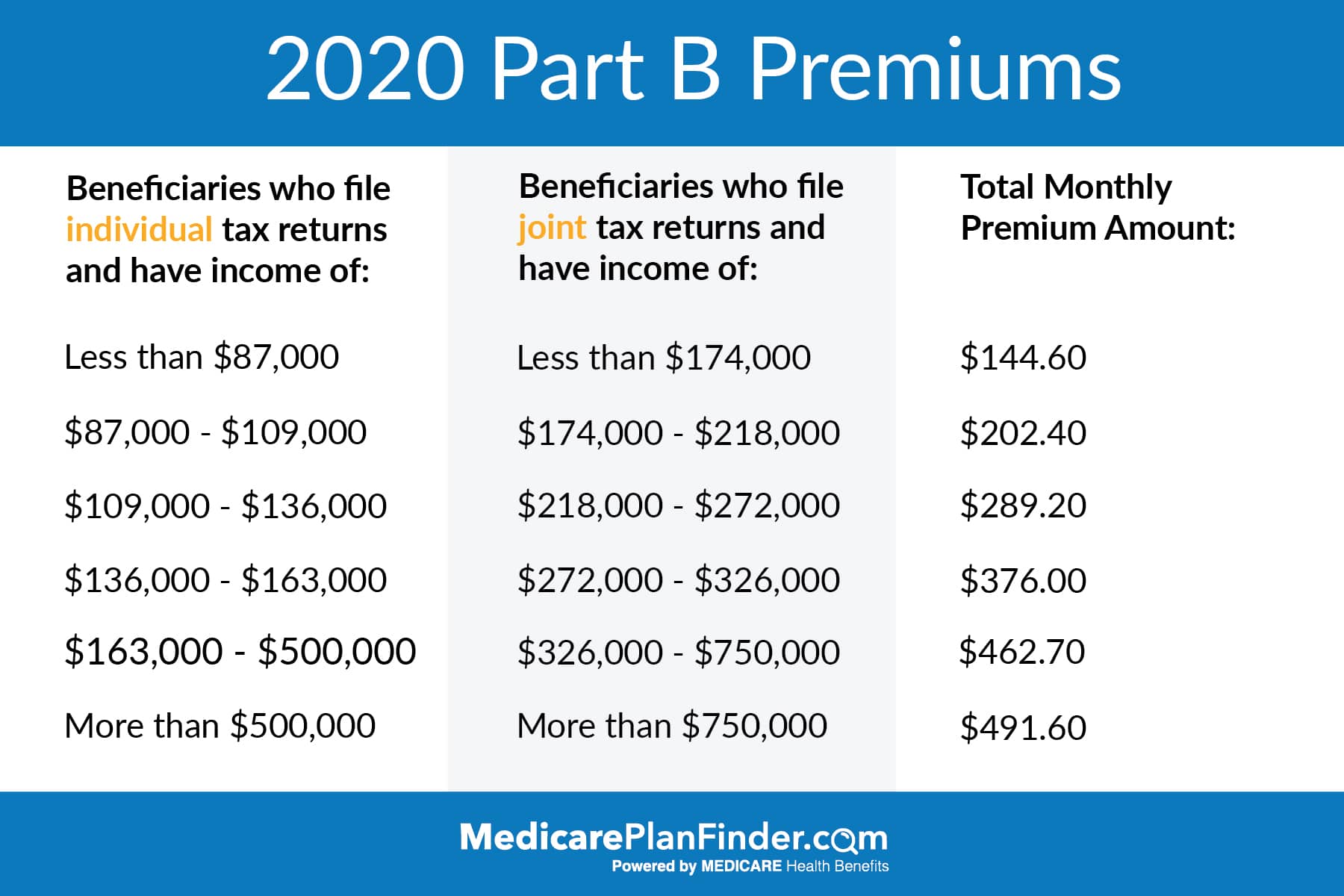

You must have both Part A and Part B to enroll in a Medicare Supplement Insurance plan; the plans only work with Original Medicare and can’t be used to help pay the out-of-pocket costs of a Medicare Advantage plan. You also cannot buy a Medicare Supplement Insurance plan if you have a Medicare Medical Savings Account (MSA). You will pay a separate monthly premium for your Medicare Supplement Insurance plan in addition to your Part B premium.

Medicare Supplement Insurance plans are offered by private insurance companies. Not all plan types may be available in all areas.

How Much Does Medicare Pay

Want to know more about Medicare Supplement insurance plans? We are happy to give you more information and answer your questions. If you prefer, you can schedule a phone call or request an email by clicking on the buttons below. You can also find out about plan options in your area by clicking the Compare Plans button.

Medicare Advantage Hospital Copay

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.